Welcome to the latest edition of The Week that Was, my rundown of what happened last week, curated, in the loosest sense of the word, for your reading pleasure, or displeasure.

This week we’ve got to take sad delight in TACO and the spectacle of Trumpian self-pity. Elon Musk could not even come close with his self-pity, perhaps aiding by his extensive use of a variety of psychopharmaceuticals.

The biggest story you’re probably not reading about is crypto and the scam economy, which seems destined to lead to the next financial crisis.

1. Photo of the Week: A Man in Gaza Carrying Food

Photo © AP Photo/Abdel Kareem Hana

Think about this as you are sitting down to dinner.

2. Trumpian Self-pity

Taco.

Let’s see, taco, a classic Mexican dish, consisting of one or more tortillas, corn tortillas only, thank you, and a filling of usually meat, and with seasoning. And salsa picante. There are many types; below is a type, the famed taco al pastor, a delightful Mexico City specialty.

Photo © Ben Herrera

Tacos and tortillas date back to pre-Hispanic Mexico, by the way. In other words, another gift from one of the world’s great and ancient cuisines.

And then there is TACO, an acronym developed by the ever-sarcastic tribe of Wall Street traders. TACO means “Trump Always Chickens Out,” and it’s the nickname of a trading strategy of betting that a stock or security hit by a Trump tariff will soon recover when the tariff is reduced or lifted, as has been the pattern.

The acronym dates back almost a month, almost antediluvian in this hyper speedy media cycle, as reported by Robert Armstrong of The Financial Times. It started with the comeback of the market

“How to make sense of stocks rallying, spreads tightening and gold falling — while oil and yields are telling you that the growth outlook continues to get worse?

“… the recent rally has a lot to do with markets realising that the US administration does not have a very high tolerance for market and economic pressure, and will be quick to back off when tariffs cause pain. This is the Taco [emphasis added] theory: Trump Always Chickens Out. But why doesn’t that translate to resurgent growth hopes, higher yields and more expensive oil?”

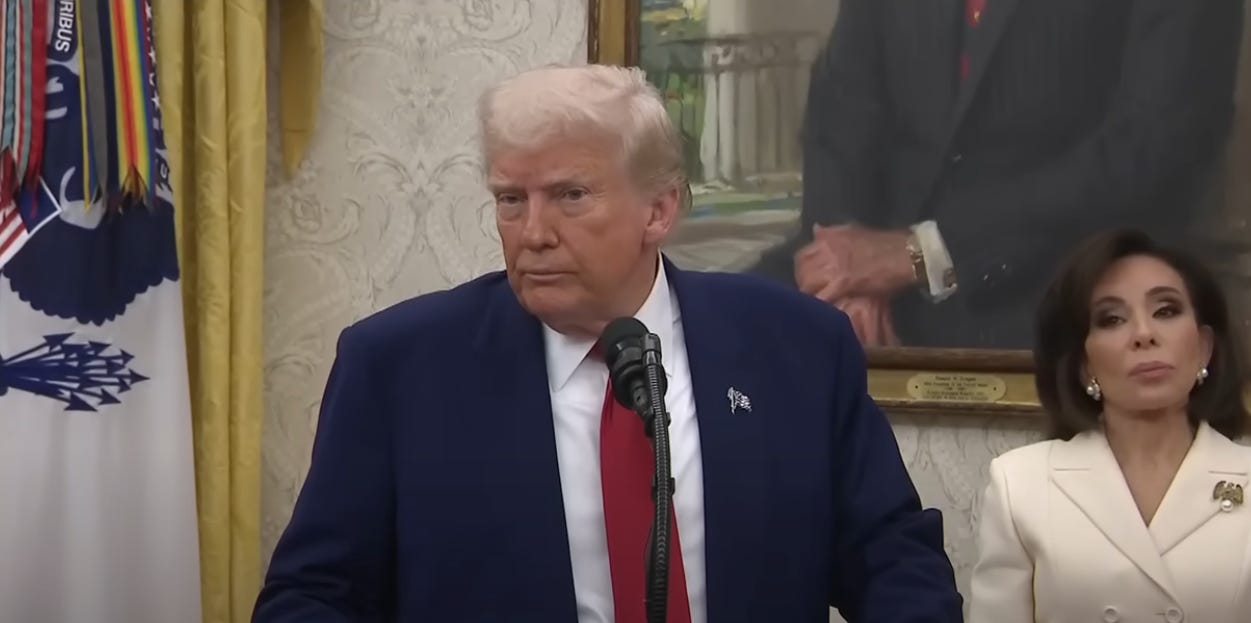

And so TACO went, under the radar, until on Wednesday, May 28, Megan Casella of CNBC asked Trump about the TACO trade, with Jeanine Pirro in the background wearing a Mission Impossible style mask, except of herself.

Photo © WSYX ABC 6

“Please. Mr. President, Wall Street analysts have coined a new term called the taco trade. They’re saying that Trump always chickens out.”

Trump proceeded to descend into a fact-free semi-coherent tirade of self-pity in which he said the European Union wanted to meet desperately and then contradicted himself and then said

“…we have 14 trillion dollars invested, committed to investing ….” [spoiler: impossible]

And then Trump delivered the money shot, at 01:08:

“…we have the hottest country anywhere in the world. [quick question: are there countries elsewhere besides the world?] I went to Saudi Arabia. The king told me, he told me, ‘you got the hottest c [sic], we have the hottest country in the world right now.'”

And that’s why he raping us blind. More on corruption below.

Trump lashes out at reporter who asks about him 'chickening out' of tariff threats

This story has gained traction, as they say, in many places. A Los Angeles publication, L.A. TACO, speculated what a Trump taco would be, possibly including Doritos and a mayonnaise dispending spackle gun, or perhaps:

“A large lump of dry old pork on a pre-packaged flour tortilla made in New York.”

As an aside, there are some very good tortillas made right here in Brooklyn. Check out Los Hermanos sometime.

Photo © Los Hermanos

TACO has spawned some memes as well,

Source unknown.

And yard signs.

3. Trump Claims CBS Interview with Kamala Harris Hurt His Feelings

Trump’s lawsuit against CBS has taken a mental turn.

“President Donald Trump suffered “mental anguish” from CBS News’ editing of a “60 Minutes” interview with Democratic opponent Kamala Harris last fall, his lawyers are arguing in court papers.

“Trump’s status as a ‘content creator’ was also damaged by attention given to the interview, lawyers said. It was part of their argument opposing CBS parent Paramount Global’s effort to dismiss the president’s $20 billion lawsuit against the company, filed Wednesday in U.S. District Court in Amarillo, Texas. Trump has claimed the editing was done to advantage Harris, which CBS rejects.”

You read that right. Trump is seeking $20B in damages for an interview of Kamala Harris.

Trump suffered ‘mental anguish’ from disputed CBS News interview with Harris, lawyer says

4. Don’t Count Trump Out

In spite of the twists and turns and widespread anger at Trump, the chickening out has noticeably improved Trump’s approval rating. He’s only down 2.9 pts on RealClear Politics poll average.

© Real Clear Politics

Trump is down 10.5 pts on the economy.

© Real Clear Politics

As for the Democrats, the party is up 2.4 pts on the 2026 generic Congressional vote. That’s actually not up at all; that’s break even.

© Real Clear Politics

5. Musk Pouts and Sulks, Psychotropic Drugs or Not

On Tuesday, Elon Musk, wearing an “Occupy Mars” t-shirt, was interviewed by CBS News, and he said that he was disappointed with the “big beautiful bill”:

“So I was like disappointed to see the massive spending bill, frankly, which increases the budget deficit….”

Elon Musk explains why he was disappointed by Trump's "big, beautiful bill"

Elon Musk has left the administration, sporting a shiner. Musk’s incoherent money grab masquerading as public service alienated Trump, after only four months.

It’s not hard to see why: mounting an incoherent money grab masquerading as public service is Trump’s job.

“He dramatically reduced his target for cutting spending — from $2 trillion to $1 trillion to $150 billion — and increasingly expressed frustration about resistance to his goals.”

A Bruised Musk Leaves Washington: Takeaways From the Trump News Conference

As it turns out, as everyone already knew, a lot of the time Elon Musk was high as a kite on ketamine and ecstasy and shrooms and Adderall and who knows what else.

“Mr. Musk’s drug consumption went well beyond occasional use. He told people he was taking so much ketamine, a powerful anesthetic, that it was affecting his bladder, a known effect of chronic use. He took Ecstasy and psychedelic mushrooms. And he traveled with a daily medication box that held about 20 pills, including ones with the markings of the stimulant Adderall, according to a photo of the box and people who have seen it.”

On the Campaign Trail, Elon Musk Juggled Drugs and Family Drama

There have been reports going back several years Tesla’s board having concerns about Musk’s drug use, but then apparently Musk allayed those concerns by getting high with some of them.

WSJ: Elon Musk took drugs with some Tesla board members

But it seems that Musk is not alone. Sort of tech executive peer pressure, I guess.

Elon Musk Drug Use Concerns Business Leaders | Pivot

Now Musk is trying to salvage his image, which seems to be a herculean task if there ever were one. And I do find the use of the word “rehab” interesting. Will his buddies, both of them, soon be staging an intervention?

“Elon Musk pivoted to damage control in his final days as a ‘special government employee,’ publicly recommitting to Mars, cars and robots after a bruising year in the political limelight.”

Musk confirms exit from Trump administration amid image rehab tour

6. The Next Financial Crisis

Meanwhile, the pathway to the next 2008 is being cleared.

First of all, on March 15, the FT reported that the U.S. government is preparing to reduce reserve requirements on banks imposed after the 2008 financial crisis.

“The biggest eight US banks currently need to have so-called tier one capital — common equity, retained earnings and other items that are first to absorb losses — worth at least 5 per cent of their total leverage.”

That means greater risk.

US poised to dial back bank rules imposed in wake of 2008 crisis

And the next factor leading to speculation and the next bubble is crypto. And it looks like there is not going to be any restraints on what is, essentially, air.

“The GENIUS Act will allow crypto currencies all to flourish as never before. Backed by nothing. Not even worth the electrons in the ether or the magnetic signatures on the servers in tax havens.

“The GENIUS Act, a sweeping cryptocurrency law that could spread fraud-ridden, destabilizing digital currencies across the banking system. [The GENIUS] would allow Elon Musk and other Big Tech tycoons to issue their own private currencies.

“That means we could soon live in a world where all online transactions will require us to pay for goods in billionaires’ own made-up monopoly money, for which tech giants will be able to charge exorbitant transaction fees.”

The Trump Administration is rapidly removing any restraints on crypto.

“The pacesetter for this trend is MicroStrategy, once a reasonably successful enterprise software company that now owns about 1 in every 40 Bitcoins in existence, whose CEO has become a Bitcoin celebrity, constantly hosting events for executives to learn about adding Bitcoin to their company portfolios. (Selling to one’s peers is a core strategy of any multilevel marketing scheme, which Bitcoin in some ways resembles.)

“These are the increasingly hallucinatory economics of crypto-laden corporate balance sheets, which ring out with risk and contradictions. But buying tokens from the president of the United States is another innovation entirely, a form of corruption so obvious that even some frontline Democrats have begun calling it for what it is: the biggest financial scandal to ever hit the presidency.”

16 Democratic Senators voted to advance this act.

What’s next for the GENIUS Act

Asset bubbles happen when an excess of money chases assets and drives their prices up beyond any real value in the asset. But the price keeps going up until, suddenly, market participants realize that the underlying value of the asset is only a fraction of the inflated price. This is what happened with the Tulip mania between 1634 and 1637, the first major asset bubble in world history. That’s what happened in 1929. And that is what happened in 2008.

This is occurring in the midst of what is a boom time for scams, the essence of the Trump era.

Do you desperately need medical care you cannot afford? Don’t worry, a high interest credit card with high fees can be yours.

Predatory Lenders in the Operating Room

The Executive Editor of The American Prospect, David Dayan, discussed the golden age of scams on The Majority Report.

The Prospect Weekly Roundup x Majority Report: May 30th, 2025

Obviously, though, there is nothing to worry about. Scott Bessent, the Treasury Secretary who serves the creator of all of this, has issued an ironclad guarantee.

“’The United States of America is never going to default, that is never going to happen,’ Bessent told CBS’s Face the Nation on Sunday. “We are on the warning track and we will never hit the wall.”

Treasury secretary Scott Bessent insists US will ‘never default’ on its debt

7. Foreign Affairs: Outside the Bubble

At least Ukraine is still fighting.

Ukraine launched drones from trucks parked deep inside Russia in ‘modern Pearl Harbor’ attack